One of the things that came out of today’s Global Market Forecast at Airbus was how the company is defining its product line up

And it’s interesting, to say the least – with certain aircraft filling into more than one role.

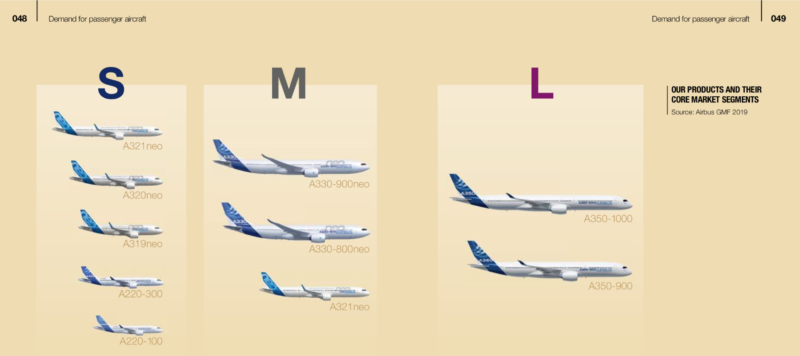

Here are the diagrams from the day that we are going in-depth in:

From the Airbus Global Markets Presentation

From the Airbus Global Markets Forecast document – downloadable at https://www.airbus.com/aircraft/market/global-market-forecast.html

Or for those who don’t like charts:

- Small Aircraft: A220 family, A320 family

- Medium Aircraft: A321XLR, A330neo family

- Large Aircraft: Airbus A350 family

Or for those who don’t like charts:

- Small Aircraft: A220 family, A320 family

- Medium Aircraft: A321XLR, A330neo family

- Large Aircraft: Airbus A350 family

Let’s break this down a bit.

The small end of the market

Carriers are up-scaling the seat counts in their Airbus A320 family aircraft – with the old 170 seaters being increased to 210 seats per aircraft. Meanwhile, the 100-150 seat market for Airbus has been taken over by the A220. To quote Airbus Chief Commercial Officer Christian Scherer

The A220 (known as the CSeries) actually brought a lot of value to this market and I do confess the A220 is offering economics that are better than A319. That’s why we brought it for a very expensive Canadian Dollar.

To say the Airbus A319neo is dead and buried isn’t an exaggeration as the A220 has comfortably taken its place. Especially after today.

The Middle Ground

As airlines seek to save on trip costs, they’re turning to equipment to do other roles. The best example of this the medium category where both the Airbus A330neo family and A321LR/A321XLR sit together. At this end of the market, they are offering the same per-seat cost per trip on the 7 to 8-hour mission. Flipping this around, it isn’t uncommon for airlines to utilise the heavy lift of an A330 on a short-ish haul leg (either filling in for another service or to provide a capacity boost), where the A321XLR/LR has the low trip costs.

This family now scales from 210 to 460 seats.

The large market

This is where high capacity and low cost per trip comes into play – and airlines are looking for the best value for their long/large distance market trips. Of course, this is represented by the A350-900 and A350-1000 – and where the fuel burn technology matters to reduce costs, whilst in

The breakdown

The current predictions by Airbus show their anticipated demand for the next 20 years.

- 76% Small (29,720 units)

- 14% Medium (5,370 units)

- 10% Large (4,120 units)

Within that, there is plenty of room for competitors to fight it out for for a slice of this market. With both entries from Russia and China coming, it will be interesting to see how acceptance of those types are in the longer term

Economy Class and Beyond was a guest of Airbus at their Global Markets Forecast Event in London.

Welcome to Economy Class and Beyond – Your no-nonsense guide to network news, honest reviews, with in-depth coverage, unique research as well as the humour and madness as I only know how to deliver.

Follow me on Twitter at @EconomyBeyond for the latest updates! You can also follow me on Instagram too!

Also remember that as well as being part of BoardingArea, we’re also part of BoardingArea.eu, delivering frequent flyer news, miles and points to the European reader