Editors note Yes. After a few days nursing a cold and getting serious sleep – I’m back and ignoring the comments queue. Expect normal service to resume over the next few days as I sniffle my way through a keyboard… and develop my reading skills.

It’s been a fraught few days for UK operator FlyBe as some companies didn’t realise what it was on the hook for – pushing it dangerously close to the edge of survival.

FlyBe de Havilland Dash 8 Q400 at Birmingham Airport – Image, Economy Class and Beyond

Only an intervention by the UK Government seems to have allowed the airline to survive… for now.

Let’s take a step back – how did FlyBe get here?

FlyBe can trace its routes back to Jersey European Airways and its rebrand British European and beyond. Its focus has always been on regional operations as the airline moved from operating to and from Jersey to UK regional and European connections.

It grew from its old fleet of BAe146s, through to Embraer E-195, E-175 and deHavilland Aircraft Canada DHC-Dash 8-400 and ATR Aircraft.

In 2006, the network expanded with the purchase of BA Connect network (save the London City Network, which was rebranded as BA CitiFlyer).

Flybe continued along operating primarily out of the regional airports in the UK (i.e. anywhere other than London Heathrow). In recent years, it commenced operations out of Heathrow and City Airport.

Loganair also joined up with Flybe franchisee (after being dropped by British Airways). They left in October 2017 as an independent airline.

In 2019, Connect Airways took over FlyBe (made up of Stobart Air, Cypress Partners and Virgin Atlantic). And that was meant to guarantee the future the f the airline.

Fast forward to 2020

On Sunday, reports emerged of FlyBe in difficulty, with the airline was seeking fresh funding. By late Monday, negotiations with the UK Government had begun. By late Tuesday, a rescue plan had been agreed for payment of its debts and for its owners to pump more money in.

And by today (Wednesday), the rescue is being attacked by climate groups, competitors and IAG – who have filed a complaint to the EU.

The Network

The core thing to consider for FlyBe is the actual network. This isn’t a traditional hub and spoke or point to point, – somewhat a mixture of the two. Another thing to note is that it is NOT London Centric.

It can be split into three main categories:

- UK Domestic (Mainland)

- UK, Ireland and the Channel Islands

- European connectivity

Let’s look at a few maps that show examining some of Flybe’s hubs shows their spread.

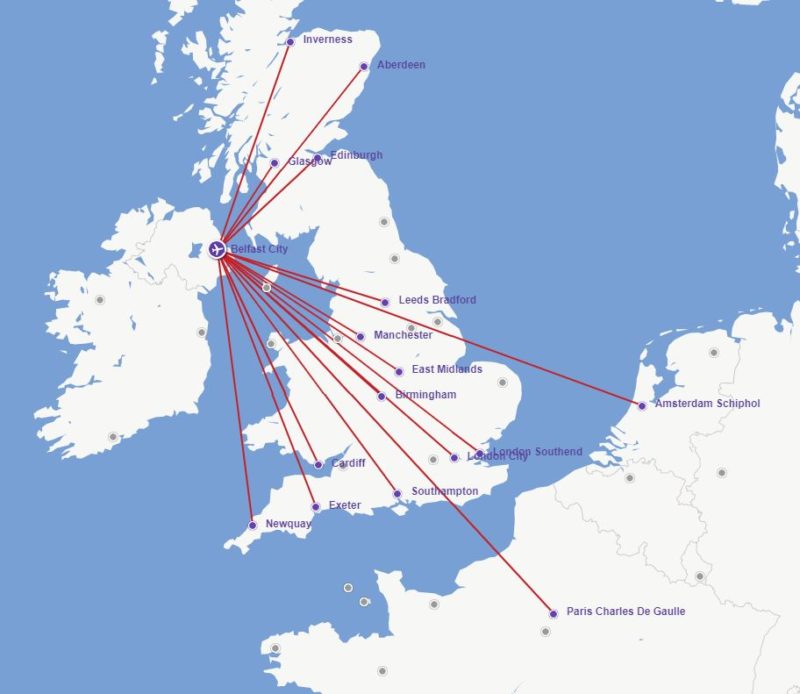

Belfast

Belfast is primarily UK Domestic – with the added feature of crossing the Irish Sea to connect to the UK mainland. Routes to Amsterdam and Paris provide its European connectivity.

Newquay

UK Domestic routes, with two connections to the Channel Islands

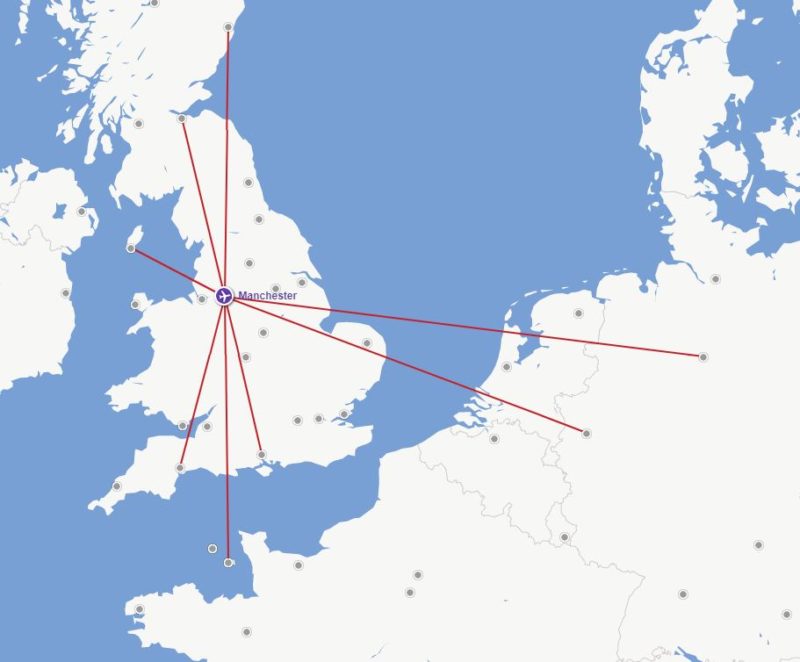

Manchester

Mostly domestic, with two routes to Germany.

Birmingham

If there is an “International hub”, Birmingham is it.

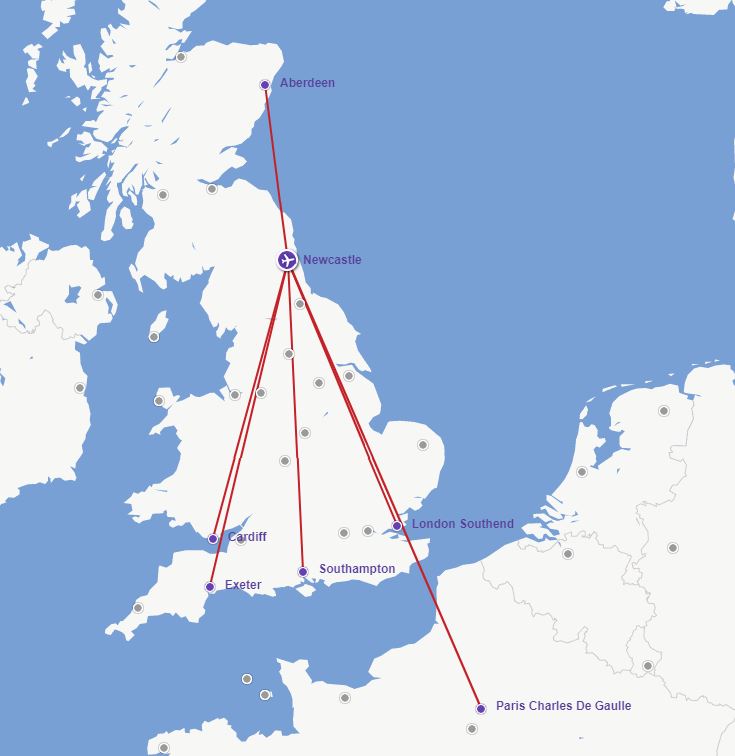

Newcastle

If you want diverse, it’s FlyBe creating the regional connections

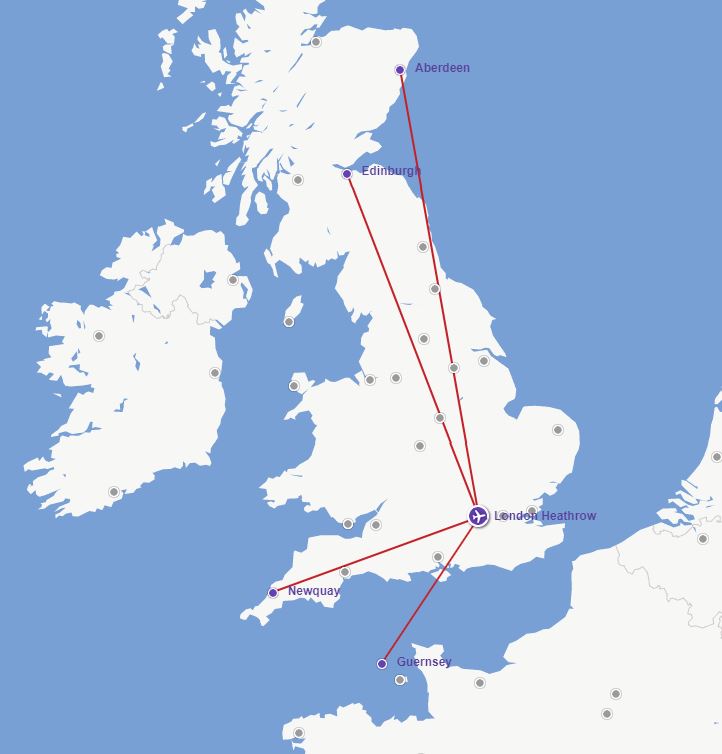

London LHR

An alternative feeder to British Airways. You bet.

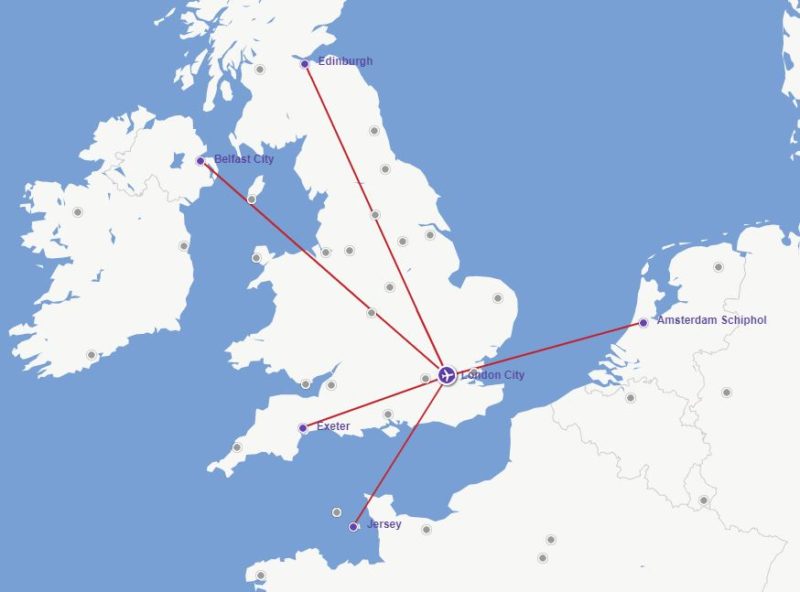

London LCY

A fair mix out of City Airport.

Maps – Flybe.

The Rail “Challenge”.

Whilst there are rail connectivity options in the case of all the UK Domestic flights, there would be a requirement to either change along the route or take a longer and convoluted route.

In some cases, there may be a valid way of rail challenging flying FlyBe domestically (e.g., London to Newquay)… if there was a faster option. The problem, of course, is that “High Speed” services on the Great Western lines are limited for the amount of journey. The rest of the journey can be rather pedestrian. And if you’re on limited time, that could be a no-go.

Especially on routes that cross the country, it’s time-consuming so say the least that might even make a car journey viable rather than dealing with trains.

And let’s not forget – people will pay for speed and convenience, rather than waiting for a train.

Regional competitors

The regional space in the UK is littered with companies that have gone to the wall – with LoganAir and Blue Island, Eastern Airways being the few survivors. These are trying to carve out routes and survive in their own ways. But are still competitors, with some route duplication.

Regional flying is more than a little different

British Airways has another moniker – London Airways – for a very good reason – when it abandoned its BA Connect product (and sold it to Flybe), focusing on London airports as its primary destinations.

The problem, of course, is that there a lot more to the United Kingdom that Greater London/M25 area and the nature of these routes are thin and short – and won’t fill an A320 or 737, rather they need efficient regional aircraft (be it ATR, or DHC, Embraer’s)

In some cases, routes are operated under a Public Service Obligation (the aforementioned London to Newquay route), but in the majority of cases – it is a commercial decision were to fly the aircraft.

It’s a different beast to the big domestic trunk routes, or even some European flying.

What to do?

Let’s work through the issues

- Network – I would have hoped Connect Airways would have got a grip at this point and started slicing out the bits of the network that are failing to make money. It seems they haven’t go there yet – and this is where it will hurt them. And yes – some routes that have UK Domestic connectivity may have to go to keep the airline alive (especially when rail travel is more than an easy to access option). As for the European routes, the airline is going to have to stop competing with the Low-Cost Carriers and focus on the routes that can fill an aircraft up with paying passengers.

- Fleet – FlyBe’s fleet is large – with 69 frames in its fleet in total. Whilst this might have been suitable in the past, it’s currently not fit for purpose in terms of its size. And yes – it’s going to need cuts as unprofitable routes are sliced away.

- Air Passenger Duty Reform – Whilst IAG may moan, it actually stands to GAIN from APD reform in a domestic package, with lower costs to fly regionally from London.

EasyJet and Ryanair gain would too. Let’s not forget that APD is levied by the government, and it was not forced on any party. As to how to reform… it’s a good question. There will be pressure from other lobby groups too.

Interesting analysis from RDC shows easyJet would benefit the most from APD reform on domestic flights – with the most number of seats in the market, followed by flyBe and British Airways. pic.twitter.com/wvQLlrhCsO

— Ashley Quint ✈ 🌴 (@LuxuryTravelled) January 14, 2020

- Connect Airways needs itself needs to work out what it wants – Whilst Virgin Atlantic is a leader in the Connect Airways ownership, Stobart Air and Cyprus Partners have its part to play too. And that means stumping up the cash or selling out their share of the airline. For all parties, it comes to the classic takeover question. Pay-up or Shut-up. If Virgin Atlantic and co are so desperate for this feed traffic, pour some more cash in.

A ground-up reform

If FlyBe wants to survive – rather than lurch from crisis to crisis, it’s going to have to reform itself. This could be into something a lot leaner, running with different aircraft, which is focused on PSO routes and some core “Trunk routes” connecting the UK domestic market, along with European routes that make fiscal sense, rather than covering every regional option out there.

It’s going to be hard – let’s not beat about the bush as the airline shrinks to something that more manageable and hopefully – more sustainable for the future.

Because let’s be honest – if these routes go, would any carrier want to step in?

Welcome to Economy Class and Beyond – Your no-nonsense guide to network news, honest reviews, with in-depth coverage, unique research as well as the humour and madness as I only know how to deliver.

Follow me on Twitter at @EconomyBeyond for the latest updates! You can also follow me on Instagram too!

Also remember that as well as being part of BoardingArea, we’re also part of BoardingArea.eu, delivering frequent flyer news, miles and points to the European reader.