I’ve got to admit, there’s one thing that does annoy me when shopping aboard is Dynamic Currency Conversion.

Dynamic Currency Conversion is when you go to an ATM or a shopping console and you’re presented with a choice either to pay in a local currency or with an amount in your home currency before you hit buy.

Here are two examples below from my current trip to Singapore.

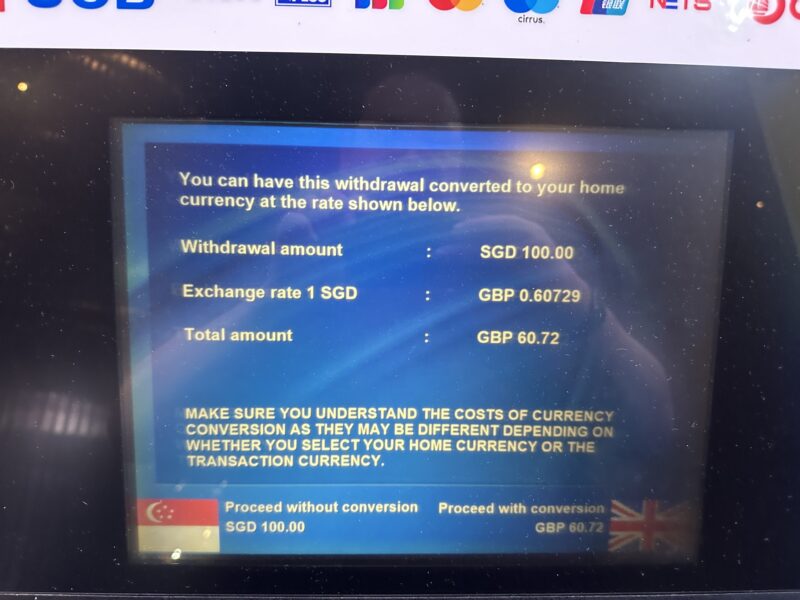

From a UOB cash machine, when I wanted to withdraw S$100:

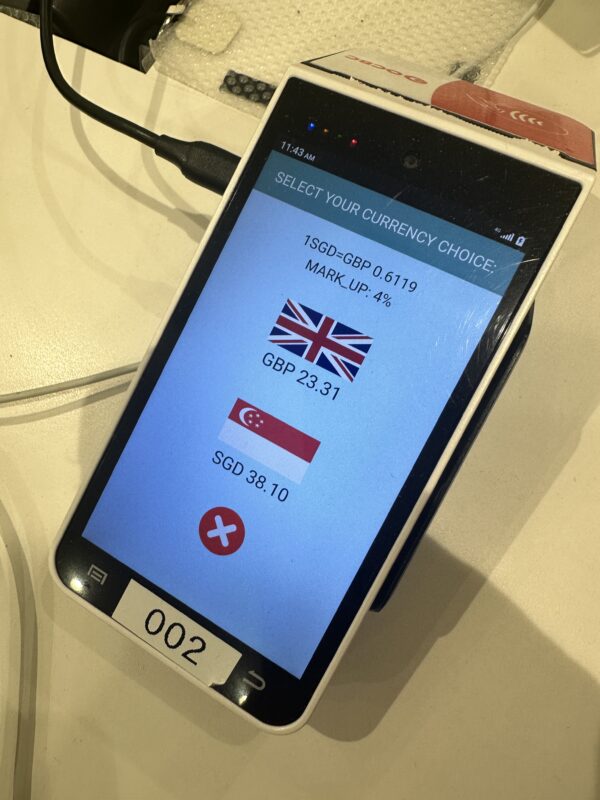

And Tokyu Hands, well wanted to settle a transaction for some goods.

DDC has an issue – the price you see in your home currency won’t be as good as the daily fee Visa or Mastercard might offer with a markup slapped on top of it. Whilst some might be happy to see an amount in their home currency (and pick the easy option), it comes at the cost of the fees lined up.

At least they present the exchange rate.

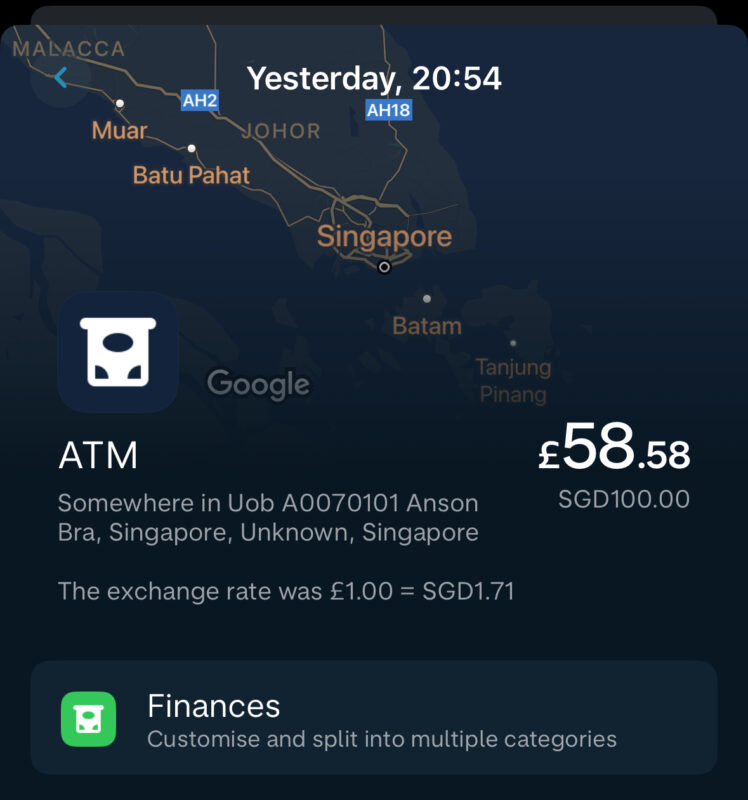

Let’s look at the two examples I’ve got. Back to the ATM. For this, I used my Monzo Debit Card. This offers a limited amount of fee-free cash withdrawals aboard (free in the European Economic Area, and up to £200 every 30 days anywhere else. After that, 3%.charge at the free account).

So, £60.72 from UoB, £58.58 from Monzo direct including any fees. That’s a tidy saving of £1.14 for not going with a direct conversion.

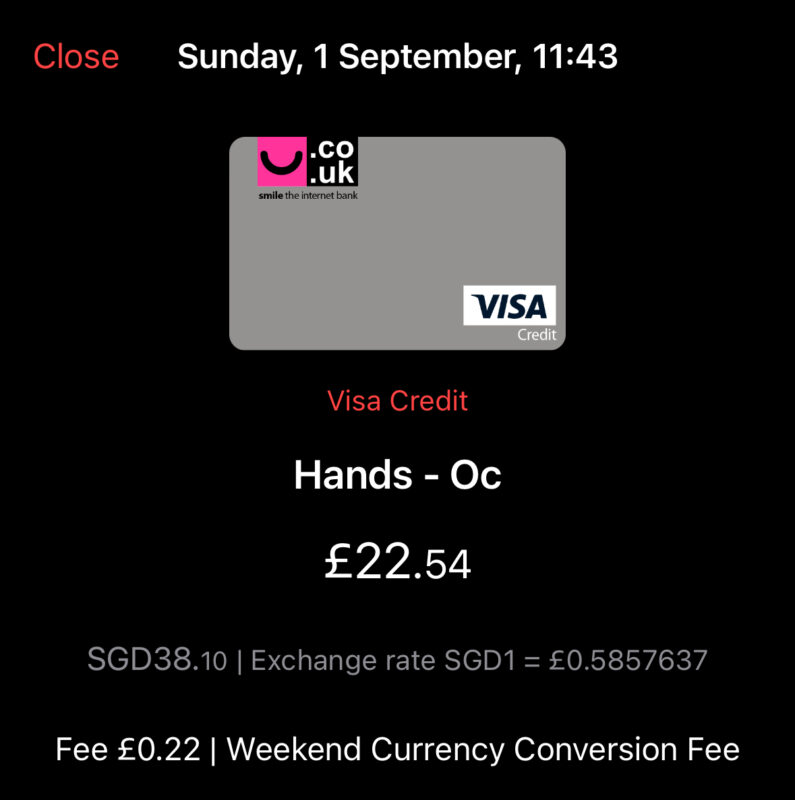

How about at Tokyu Hands? For this, I used Curve to front the transaction, with a Visa Card underneath supporting it. This being a weekend, a weekend fee is applied with limits.

A little more marginal with the weekend fee – but £23.31 from the shop, £22.54+ £0.22 for Curve still comes out as £0.55. savimg.

It doesn’t take much to do the math and work out that as you spend more the scaling up of those fee savings adds up – fast

But help yourself first

There are ways to reduce the costs of using your card abroad – and I know this isn’t going to please the mileage-earning crowd a lot – but shop around for fee-free credit cards, accounts and fronting services.

You might find reading the primer on Wikipedia is as interesting as watching paint dry – but it explains a lot more about Dynamic Currency Conversion than I would like. If you want a friendlier version, Martin Lewis of Money Saving Expert has his thoughts on this topic and adds where the tipping points may make it better value… Or not (especially if you are subject to transaction fees on your payment method).

This requires that one thing we all need to do – plan before we travel to ensure you don’t get ripped off too hard when shopping abroad.

A note on links

As this blog is not registered with the Finance Conduct Authority, I am offering no recommendations of what card. to use or subscribe to, and you should always check if a product is right for your circumstances. As such, links to Monzo and Curve are provided “as is”, with no referral code. The author is a customer of these products, with Monzo being a paid product and Curve being used as a free product.

Other challenger banks that offer similar features to Monzo include Starling and Revolut. Another fronting service includes Currensea.com. The author holds no position on these products.

Welcome to Economy Class and Beyond. Your no-nonsense guide to network news, honest reviews, in-depth coverage, unique research, as well as the humour and madness I only know how to deliver.

Our Social Media pool has expanded. You can find us across most networks as @economybeyond on Twitter, Mastodon,

Also, remember that we are part of the BoardingArea community, bringing you the latest frequent flyer news from around the world.

xz

xz

Note that Curve has removed weekend fees on all cards except the Lite card.

Good to know. Thanks