When I was travelling to Romania, I needed to get some local currency out.

Sometimes hard cash is a useful thing to have to hand (and in the end, I didn’t need hard currency – but that’s beside the point, it’s better to be prepared than not).

Rather than hitting a cashpoint at the airport (least of all they have the EuroNet ones which have… more than a few issues, which Honest Guide has covered), I ended up at a cash machine at local bank near my hotel.

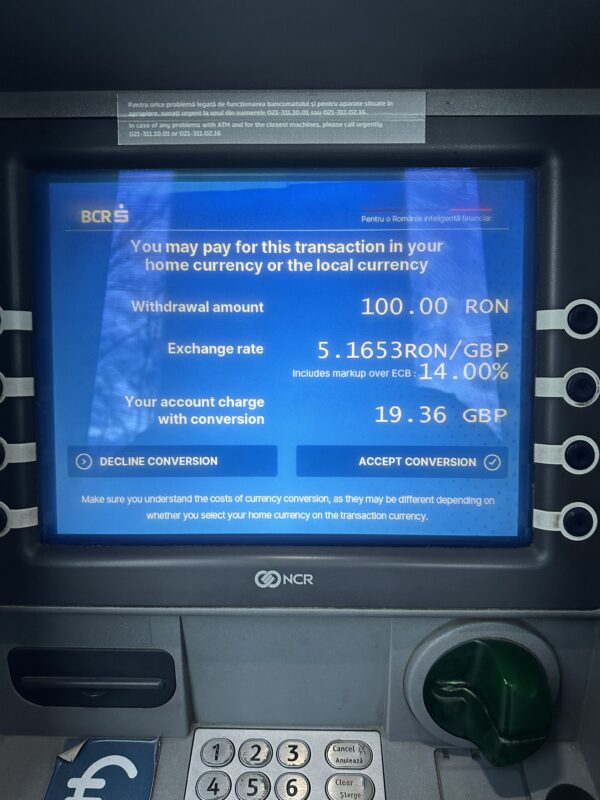

Imagine my lack of surprise when I went to hit the withdrawn button… the joy of Dynamic Currency Conversion (DCC) appeared when I went to withdraw 100 Lei.

Let me be clear: This. Is. A. Rip. Off.

Dynamic Currency Conversion (DCC) is when you go to an ATM or a shopping console and you’re presented with a choice either to pay in a local currency or with an amount in your home currency before you hit buy. There’s a deeper dive on Wikipedia on the pros and cons of this .

DDC has an issue – the price you see in your home currency won’t be as good as the daily fee Visa or Mastercard might offer with a markup slapped on top of it. Whilst some might be happy to see an amount in their home currency (and pick the easy option), it comes at the cost of the fees lined up for that knowledge of how much you’re paying on screen.

So let’s apply this knowledge to the example above.

Thankfully, EU Rules direct ATM withdrawals to show the markup that a bank will charge to withdraw cash – in this case, a 14% markup over the ECB rates.

Let that sink in. A Fourteen Percent Markup.

Ouch.

Let’s break this down further – I use Monzo when travelling to handle my payments. This offers a limited amount of fee-free cash withdrawals aboard (free in the European Economic Area, and up to £200 every 30 days anywhere else. After that, a 3%.charge at the free account).

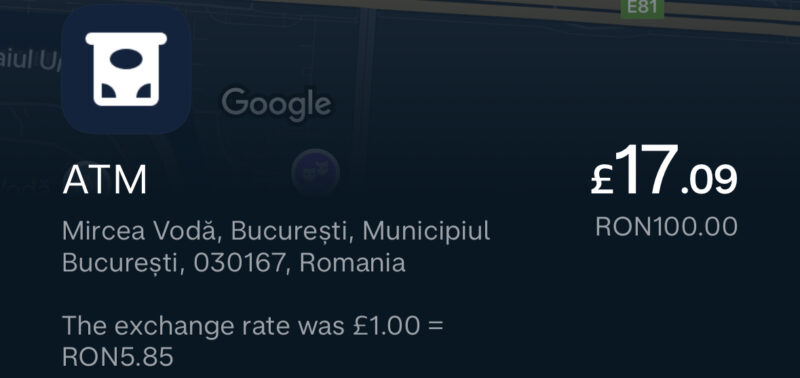

How much did Monzo charge me for withdrawing 100 Lei?

That’s still a slight markup on the XE.com rate of £16.85 (around 24p difference), but not as embarrassing as the DCC offering.

Let’s use basic mathematics to prove this point.

BRC wanted to offer 5.1653 Lei to £1. Monzo on the other hand, was offering 5.8.5 Lei to £1.

Based on their offerings above

- BRC = £19.36

- Monzo = £17.09

That equals a £2.27 saving, comparing DCC to a normal withdrawal

Remember: Decline Conversion

Whilst that might be chump change to people, multiply that out over multiple transactions or larger amounts, and it fast turns into more money in your pocket when you hit that magic button that says “Decline Conversion”.

Especially at a 14% markup compared to the base rate (which is more than a little over the top!).

If you have a card that doesn’t charge fees for withdrawals (or refunds the fees), that’s even better.

But unless in very specific circumstances, Direct Currency Conversion remains a poor convenience at best, and an additional cost to your trip at worst.

A note on links

As this blog is not registered with the Finance Conduct Authority, I am offering no recommendations of what card. to use or subscribe to, and you should always check if a product is right for your circumstances. As such, links to Monzo are provided “as is”, with no referral code. The author is a customer of Monzo, with one of their paid product tiers.

Other challenger banks that offer similar features to Monzo include Starling and Revolut. The author holds no position on these products.

Welcome to Economy Class and Beyond. Your no-nonsense guide to network news, honest reviews, in-depth coverage, unique research, as well as the humour and madness I only know how to deliver.

Our Social Media pool has expanded. You can find us across most networks as @economybeyond on BlueSky, Threads, Mastodon and Instagram!

Also, remember that we are part of the BoardingArea community, bringing you the latest frequent flyer news from around the world.